Small business startup loans bad personal credit

A good personal credit score. The good news is that its not impossible.

Business Loans For Bad Credit Advancepoint Capital

Small business startup loans can be difficult to acquire especially for businesses without a proven track record.

. Whether its a chip and PIN or a swipe business and personal credit cards can be used for purchases online and in stores in the exact same way personal credit cards are. While you may have access to all of these options despite having a bad credit score they will likely include higher fees and will not report. Employer businesses are minority-owned according to the US.

10 Best Startup Small Business Loans For Bad Credit. Bad Credit Business Loans. First lets review how business and personal credit cards are similar.

Bad credit business loans can help you get your small business back on its feet. Loans whether personal or business tend to work best for small-business owners who have these resources. The way theyre used.

Weve gathered our picks for the best startup loans for small business owners with bad credit or no revenue. Call our live loan experts 1-800-781-5187. Universal Credit is an online lending platform that offers personal loans between 1000 and 50000 through its partners.

Bringing greater health to the small business lending market and its entire value chain starts with cleaning the data at the. NMLS ID 1240038 NMLS Consumer Access California. Explore options for crowdfunding equipment financing short-term loans lines of credit PayPal sellers and more.

That means low interest rates well below 10. Read more on Lendio and the loans they can offer your small business. Which makes cash advances easy to get even with a bad credit score.

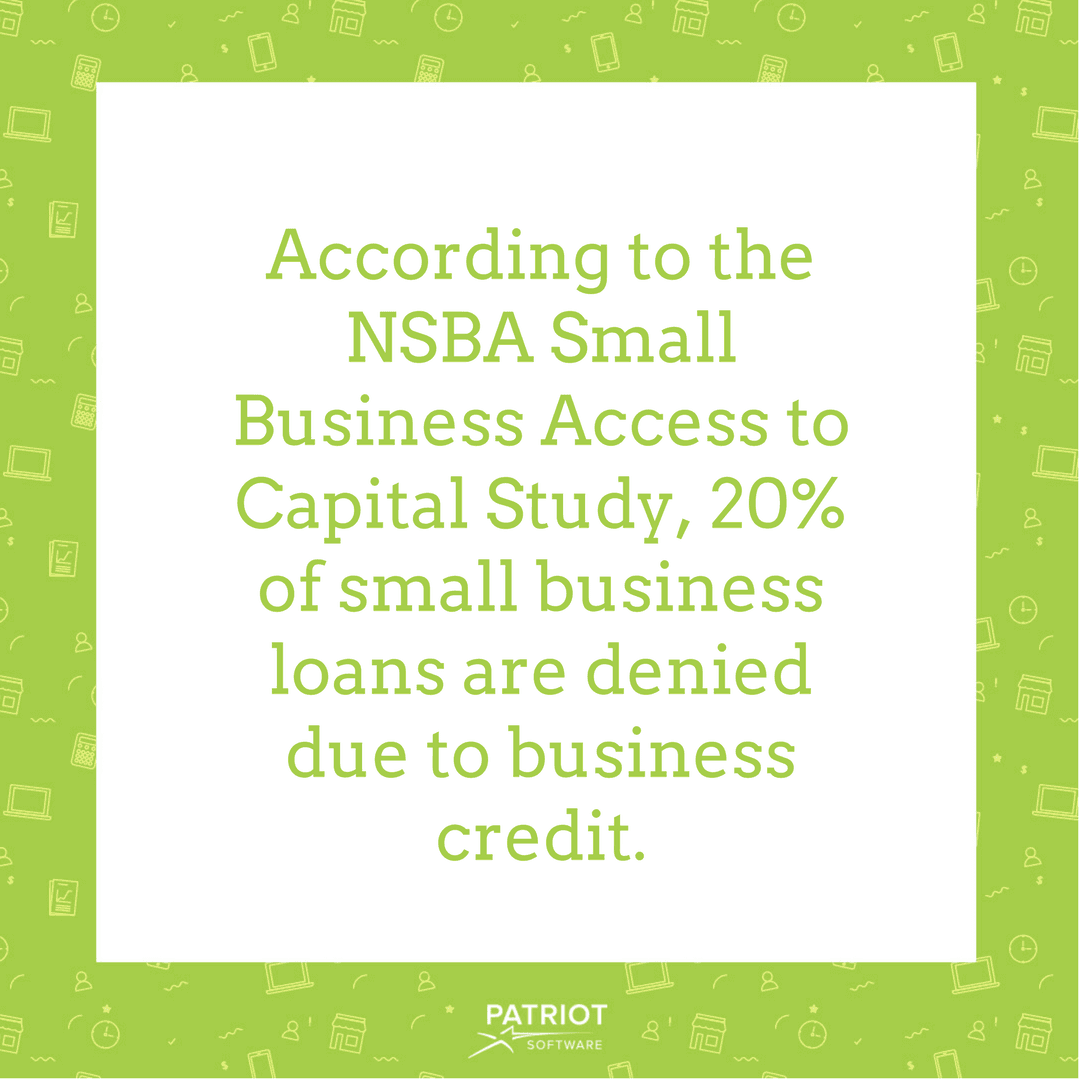

Less than 20 of US. Small business startup loan requests are more likely to be declined by. Yet the owners of these 11 million minority-owned businesses often face heightened challenges.

A low credit score can keep you from getting approved for mortgages auto loans business loans and even affect your personal loan interest rates and loan amount. California Finance Lender loans arranged pursuant to the Department of Financial Protection and Innovation Finance Lenders License 603L288. These applicants will get the best business loans or other kinds of financing such as personal loans.

A personal loan wont build business credit which could make it harder to get. Unsecured Personal Loans for Bad Credit. A business with one year or more of history.

Anyone with a less-than-perfect credit history has probably already discovered that many lenders have minimum credit score requirements. 10 options for small business start up loans. Many people overlook business credit cards as a viable business funding option especially if they have bad credit.

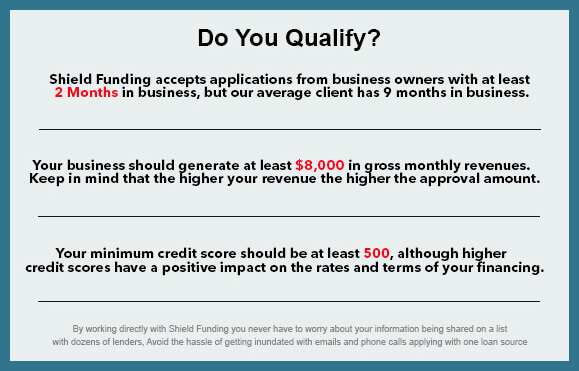

We have access to multiple lenders so that you dont miss out on a great offer. You can consider a small business loan a bad credit business loan a startup business loan or a secured business loan that requires collateral for approval. To qualify for a line of credit with BlueVine your business must be an LLC or corporation have been in operation for at least 6 months the minimum required by most online small business lenders make at least 10000 in monthly revenue or 120000 annually about 20000 more than what other competitors require and have a personal credit.

More about this loan type. But watch outmerchant cash advances cost a lot and companies usually try to disguise their true price. Here are the most common options for people who are hoping to get their hands on a startup business loan.

However business credit cards are ideal for businesses that are just starting up because business credit card issuers will use an applicants personal credit scorerather than a businesss credentialsas the main decider for their approval. Give your new business a boost in 2018 with a startup loan. Get personalized financing recommendations filtered and ranked from over 110 business credit cards lines of credit SBA loans and more.

You can choose from financing options including short term loans SBA loans equipment loans lines of credit and much more. Learn more about startup loans here and explore options from 75 best-in-class lenders. Repayment terms range from 36 to 60 monthsor three to five years.

Bad Credit History Options. With AmOne you can compare personal loans to find the best rates for major purchases and debt consolidation. Secure small business loans of up to 500000 for your small business.

Rather than just your credit score to find you the best small business loan option.

Top 10 Startup Loans For Small Businesses With Bad Credit In 2022

9 Startup Business Loans For Bad Credit 2022 Badcredit Org

20 Easy Ways To Get A Business Loan With Bad Credit Youtube

Business Start Up Loans For Bad Credit Online Loan Application Business Loans Loans For Bad Credit Online Loans

Application Process Startup Business Loans For Bad Credit Guaranteed Small Business Loans Loans For Bad Credit Business Loans

Top 10 Startup Loans For Small Businesses With Bad Credit In 2022

9 Startup Business Loans For Bad Credit 2022 Badcredit Org

How To Get A Small Business Loan With Bad Credit

Start Up Business Loans Bad Credit And No Collateral Lantern By Sofi

Bad Credit Business Loans Easy Application Fast Business Funding

Business Get Bad Credit Small Business Loans Up To 500k Business Loans Small Business Loans Bad Credit

Top 10 Startup Loans For Small Businesses With Bad Credit In 2022

How To Get A Business Loan With Bad Credit Small Business Trends

Bad Credit Business Loans Clear Skies Capital

6 Popular No Credit Check Business Loans Lantern By Sofi

Personal Business Loans The Pros And Cons Of Loans Visual Ly Business Loans Business Person Small Business Loans

Entrepreneur Startup Funding Finance Loans Business Funding